Supreme Court Judgements on GST

Publisher:

| Author:

| Language:

| Format:

Publisher:

Author:

Language:

Format:

₹3,295 Original price was: ₹3,295.₹2,636Current price is: ₹2,636.

In stock

Ships within:

In stock

ISBN:

Page Extent:

Supreme Court Judgements on GST (3rd Edition, 2025) authored by Dr. Sanjiv Agarwal and Dr. Neha Somani is an authoritative compilation of landmark Supreme Court decisions pertaining to Goods and Services Tax (GST). Published by Commercial Law Publishers (India) Pvt. Ltd., this updated edition covers all major judgments delivered between June 2017 and May 2025, providing legal clarity and interpretative guidance on various GST provisions.

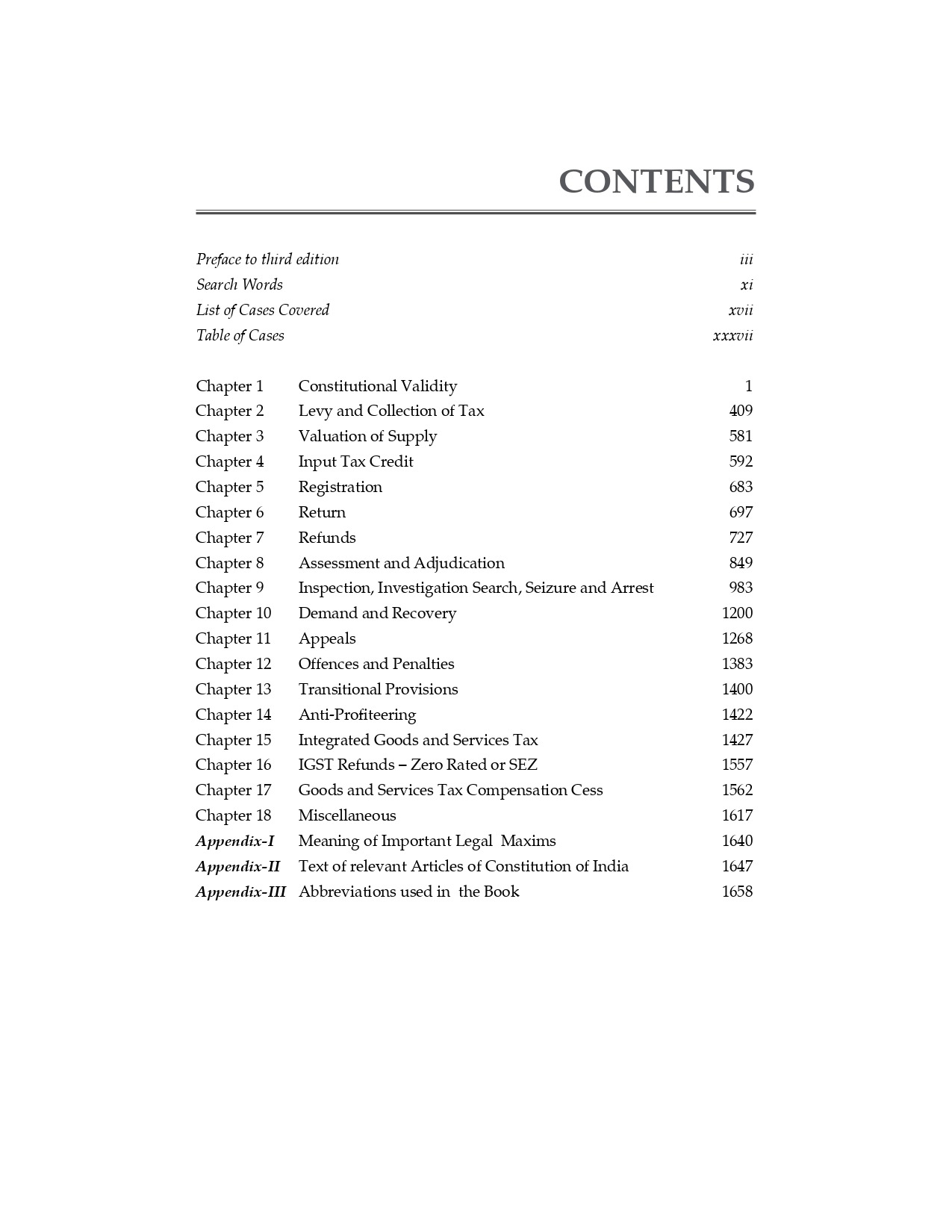

The book offers the full text of Supreme Court judgments along with lucid summaries and a digest of key pronouncements. It is designed to be practitioner-friendly with well-structured chapters covering constitutional validity, levy and collection, input tax credit, refunds, appeals, anti-profiteering, and more. It also includes a Search Words Index, a Table of Cases, and topic-wise arrangement, making navigation simple and efficient for professionals, advocates, and tax consultants.

With over 1600 pages of insights and references, this book serves as an essential resource for GST law understanding and application. It is a must-have for anyone involved in GST litigation, advisory, or academic research. The book also includes a free e-book version for added convenience.

Supreme Court Judgements on GST (3rd Edition, 2025) authored by Dr. Sanjiv Agarwal and Dr. Neha Somani is an authoritative compilation of landmark Supreme Court decisions pertaining to Goods and Services Tax (GST). Published by Commercial Law Publishers (India) Pvt. Ltd., this updated edition covers all major judgments delivered between June 2017 and May 2025, providing legal clarity and interpretative guidance on various GST provisions.

The book offers the full text of Supreme Court judgments along with lucid summaries and a digest of key pronouncements. It is designed to be practitioner-friendly with well-structured chapters covering constitutional validity, levy and collection, input tax credit, refunds, appeals, anti-profiteering, and more. It also includes a Search Words Index, a Table of Cases, and topic-wise arrangement, making navigation simple and efficient for professionals, advocates, and tax consultants.

With over 1600 pages of insights and references, this book serves as an essential resource for GST law understanding and application. It is a must-have for anyone involved in GST litigation, advisory, or academic research. The book also includes a free e-book version for added convenience.

About Author

Reviews

There are no reviews yet.

Reviews

There are no reviews yet.